|

Some of the brightest financial minds of our time are

warning of a potential

financial reckoning day for the United States.

|

|

“[A]rtificially low

interest rates and rapid credit creation

policies set by Alan Greenspan and the

Federal Reserve caused the bubble in U.S.

stocks of the late '90s.... Now, policies

being pursued at the Fed are making the

bubble worse. They are changing it from a

stock market bubble to a consumption and

housing bubble. And when those bubbles

burst, it's going to be worse than the

stock market bubble.... No one, of course,

wants to hear it. They want to buy the

stock and watch it go up 25% because

that's what happened last year, and that's

what they say on TV.”

- Jim Rogers

Financial expert and

bestselling author

Financial Reckoning Day

|

|

|

|

“On this issue of Social

Security, we got coming up in 2008 the

first of 77 million baby boomers hits

early retirement…. For the next 20 years

after that, the major contributors to

Social Security and Medicare become the

major consumers. The real deficit then

will come out of the water like a volcano.

And there is no way it seems to me we are

ever going to have a balanced budget

again, given the forces in Washington and

this perfect storm that’s ahead.”

- Pat Buchanan

Former White House

advisor, author, & NBC analyst

Scarborough Country

|

|

|

|

“If we have promised more

than our economy has the ability to

deliver [in Social Security and Medicare

expenses], as I fear we may have, we must

recalibrate our public programs so that

pending retirees have enough time to

adjust through other channels. If we

delay, the adjustments could be abrupt and

painful.”

- Alan Greenspan

Chairman, Federal Reserve

Board

Forbes

|

|

|

|

“Buffett

said the transfer of the country's ‘net

worth’ abroad would eventually lead to

‘major trouble.’‘In effect, our country

has been behaving like an extraordinarily

rich family that possesses an immense

farm. In order to consume 4% more than we

produce - that's the trade deficit - we

have, day by day, been both selling pieces

of the farm and increasing the mortgage on

what we still own.'”

- Warren Buffett

CEO, Berkshire Hathaway

& 2nd Wealthiest Person

in the World

Running on Empty

|

|

|

|

“We believe such a large

imbalance [of growing indebtedness by the

United States] is a risk not only for the

United States economy, but for the world

economy.”

- Rodrigo de Rato

Managing Director,

International Monetary Fund

New York Times

|

|

|

|

“The

outlook for the global economy is the most

uncertain for 20 or 30 years, according to

Bill Gross, the influential chief

investment officer of Pimco, the world\’s

biggest bond fund manager. ‘Too much debt,

geopolitical risk and several bubbles have

created a very unstable environment which

can turn any minute…. With all this

consumer debt, business debt, government

debt, smaller movements in interest rates

have a magnified effect…a small movement

can tip the boat…. The US dollar is being

supported by the kindness of strangers –

Japan and China. It should be 20% lower

than it is.”

- Bill Gross

Chief Investment Officer,

Pimco

Financial Times

|

|

|

|

“[D]ue to our never-ending

deficits what we're seeing is a massive

transfer of assets from the U.S. to

creditors probably the greatest transfer

of assets in history. Over time this is

going to mean a lowered standard of living

for my kids and your kids, and if it

happens quickly it will also mean a

lowered standard of living for you and me.

When you build up gigantic debts, somebody

has to pay for those debts. The great

American debt-sponsored party is slowly

coming to an end.”

- Richard Russell

Editor-Publisher, Dow

Theory Letters

Dow Theory Letters

|

|

|

|

“Gerald

Corrigan, speaking at a Boston Federal

Reserve Bank conference…warned that an

abrupt reduction of the country’s external

deficit could pose ‘systemic risks’ for

the world financial markets. ‘If nothing

happens in the next two or three years (to

reduce the current account deficit), then

the chances of a financial disruption rise

in an alarming way.’”

- Gerald Corrigan

Former President, Federal

Reserve Bank of New York

Bloomberg

|

|

|

“But

when the run on the dollar begins, OPEC

will inevitably at some point switch its

pricing to the Euro…. [I]t will be as if

the rest of the world declared war on the

United States of America by launching a

missile, dropping a bomb, or landing an

army at Bethany Beach, Delaware. And,

barring a miracle, the end results will be

exactly the same as from a physical

attack….

Buy physical gold, not paper gold. I am

convinced that we will see gold reach at

least $600 per ounce in 2005. It's a great

way to hedge against a falling dollar.”

- Michael C. Ruppert

Publisher/Editor, From The

Wilderness

From The Wilderness

|

|

|

|

“Over

time, there is only one direction for the

dollar to go – lower.”

- Bob McTeer

President, Federal Reserve

Bank of Dallas

Reuters

|

|

|

|

“Bob Rubin says we are

confronting 'a day of serious reckoning.'

In referring to our 'fecklessness,' Rubin

warns that 'the traditional immunity of

advanced countries like America to the

third-world-style crisis isn't a

birth-right.' ”

- Bob Rubin

Former United States

Treasury Secretary

Running on Empty

|

|

|

|

“Suddenly,

the U.S. economy looks exceedingly

vulnerable. The basic problem [is] that of

a saving-short U.S. economy that is locked

into the destructive spiral of

ever-widening twin deficits. Never before

has the world's dominant economic power

lived this far beyond its means.”

- Steven Roach

Global Chief Economist,

Morgan Stanley

CBS Market Watch

|

|

|

|

In describing the U.S.

budget outlook: “Chilling”

- David M. Walker

Comptroller General of the

United States

San Francisco Chronicle

|

|

|

|

“To give

you idea how big the problem is, you\'d

have to have an immediate and permanent 78

percent hike in the federal income tax [to

close a $51 trillion fiscal gap]…. The

country\'s absolutely broke, and both Bush

and Kerry are being irresponsible in not

addressing this problem. This

administration and previous

administrations have set us up for a major

financial crisis on the order of what

Argentina experienced a couple of years

ago.”

- Laurence

Kotlikoff

Economics Chairman, Boston

University

San Francisco Chronicle

|

|

|

|

“Volcker predicts we face

a 75% chance of crisis within five years.”

-

Paul Volcker

Former Chairman, Federal

Reserve Board

Running on Empty

|

|

|

|

“Since

1945...[all downturns in the US economy]

save two were intentional. The first

exception was the downturn of 1973 to

1974.... The second was the slump of 2001.

The most recent slump was...like the

structural, post-bubble depression of the

1930s. The only other structural downturn

in a major economy in the postwar period

can be found in Japan beginning in the

1990s. In the space of 11 years, Japan

went from a budget surplus of roughly 3%

of GDP (1991) to a budget deficit of

nearly 10% of GDP in 2002...bringing its

national debt to a staggering 150% of GDP.

But at least the Japanese could afford it;

domestic savings in Japan were huge.”

- William Bonner with Addison Wiggin

Investment writers and

authors

Financial Reckoning Day

|

|

|

|

|

“The U.S. is now on the

comfortable path to ruin. It is being

driven along a road of ever rising

deficits and debt, both external and

fiscal, that risk destroying the

country\'s credit and the global role of

its currency.”

- Martin Wolf

Associate Editor and Chief

Economics Commentator, Financial Times

Financial Times

|

|

|

|

|

“Forget

for a minute the economic apocalypse our

country will endure when baby boomers push

Social Security, Medicare, and retirement

programs to the brink of bankruptcy.

Instead, focus on what [Congress is]

costing you and your family today. Most

Americans work half the year paying off

taxes, fees, and regulations…. You now

[also pay for Congress’] carelessness

every time you pay your monthly credit

card bill, student loan, car lease, or

home mortgage. Washington’s runaway

deficits are now causing interest rates to

move back up. Steven Rattner…told the NY

Times, ‘The question is not whether

interest rates will continue to go up. But

rather how far and how fast.’”

-

Joe Scarborough

Former US Representative,

author, & MSNBC analyst

Rome wasn\'t burnt in a

day

|

|

|

|

“The long-term picture is

pretty bad.”

- Jagadeesh Gokhale

Senior Fellow, Cato

Institute;

& research publisher

for the Federal Reserve Bank of

Cleveland

San Francisco Chronicle

|

|

|

|

“All the

official reports, from the Congressional

Budget Office to the Fed to the IMF, keep

returning to the same bottom line: The

longer we put off any sacrifice, the

harder will be the blow to our nation, our

economy, and our lives. With this year's

record federal deficit, we are already

effectively borrowing to fund all our

domestic discretionary programs. By 2020

we will be borrowing to pay for our

defense programs as well, since revenues

by then will cover only benefit checks and

interest on the national debt.”

- Peter G. Peterson

Former Chairman, Federal

Reserve Bank of New York

Running on Empty

|

|

|

|

“The

long-term budget projections are just

horrifying. I've got four children and it

really disturbs me. I just think it's

irresponsible what we're doing to them. ”

- Leonard Burman

Co-Director of Tax Policy,

Urban Institute

San Francisco Chronicle

|

|

|

“The

direction of the dollar is down... The

dollar is declining because of our loose

money policy, our terrible fiscal deficit

and our current-account deficit, all of

which are heading the wrong way. What will

happen at some point is that foreigners

will stop buying our securities or at

least buy less of them...

Given the decline in the dollar and the

dramatic shortfall we see developing, we

expect [gold as an asset class] to be our

highest-return asset class. We look for

gold to appreciate demonstrably from here.

Our near-term target is $500 an ounce, and

our longer term target is $1,000.”

- Richard Arvedlund

Founder, Cypress Capital

Management

Forbes

|

|

|

“The

world has come to a paradoxical situation

in which the creditor countries are more

concerned with the fate of the dollar than

the U.S. authorities themselves are….

Under these conditions, the growing

interest of investors in real assets, gold

in particular, is more than justified.”

- Oleg V. Mozhaiskov

Former Deputy Chairman,

Central Bank of the Russian Federation

The Daily Reckoning

|

|

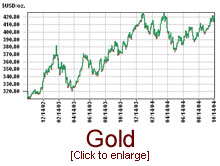

As history shows, typically the value of gold rises as

the value of the dollar falls, the following graph of the

past two years highlights this relationship and outlines

the importance of diversifying your portfolio with gold:

Gold And

The US Dollar

Oct. 15, 2002 - Oct. 14, 2004

|

|

|

|